Don’t Miss Out!

Part 1 – Creating Columns

It requires a nuanced grasp of nonprofit business models and some artful consideration of nonprofit accounting to build an accounting system that is wholly in the service of your organization’s mission and program success. At its most basic, the accounting done to track the flow of resources in and out of your organization comes down to choosing which rows (line items, chart of accounts) and columns (cost centers, departments, programs, classes, fund groups) to use. Sometimes the choice is literally which rows and columns to add to a spreadsheet or a financial statement. Sometimes the choice is a big picture exercise – the process of matching appropriate accounting rows and columns to your nonprofit’s business model. In either case, the task is not solely the responsibility of your accounting team. It takes the collective input of your whole organization to most effectively design an accounting system to reflect and manage your mission.

Columns to Match Your Organization

When our team begins the process of setting or resetting rows and columns with a new client organization, we talk first with leadership and program staff to ask their help in defining the columns. When you imagine columns on a financial report, you may be most familiar with columns labeled “Actual” or “Year-to-Date Budget”, or sometimes “Without Restriction” and “With Restriction”. While these column types are standard in nonprofit accounting, we are more interested in creating columns that match the way your organization is structured programmatically, rather than merely satisfying accounting conventions. To guide our design, we interview your team to learn how you most often and most naturally describe your work.

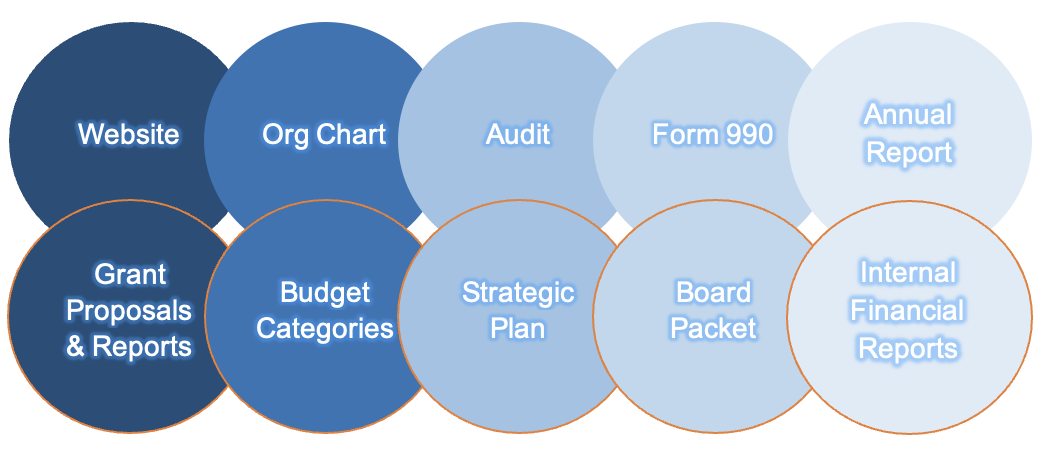

To start, we ask leaders to look at all the places the organization already describes its work. Often, nonprofits unconsciously display their business model (or at least their program delivery model) publicly on their website, on their Form 990, in annual reports, as part of a strategic plan, in grant proposals, and even in their personnel org chart. Reviewing these documents can be quite revealing, especially if an organization finds it has described itself differently across several of these platforms.

How does your nonprofit describe its work?

Once clear on how your organization is structured, we attempt to match that structure by assigning names to the columns in the accounting system. For example, in QuickBooks Online, we might use the class dimension to create columns for each of your programs or departments. But we might also create columns for fundraising and administration, the core mission supports for your programs. If your organization has special functions as part of its mission delivery, like providing fiscal sponsorships, making microloans, distributing pass-through grants, or managing a shared office space for other organizations, each of those areas might also get a column (class) assigned to it. We use sub-categories as needed to organize these classes and better display them on reports. What we aim for is to provide a useful summary of the flow of resources in and out of each of your programs, cost centers, and fund groups. By seeing various programs discreetly, displayed separately from your core program and operations, it is easier to understand and manage each aspect of your business model.

Sample Statement of Activities with Column Detail

Ideally, the way columns are set up includes enough flexibility that you can choose to share varying amounts and types of information with specific audiences. The example above includes column detail for each program, the core mission supports of fundraising and administration, and two additional funds that represent non-operating activities. This level of detail might be best suited to internal program and department leaders, and perhaps the finance committee.

The example below shows the same financial information but collapses or rolls up some of the columns to provide a more succinct picture of the organization’s finances. This summary presentation is often preferable for sharing with your board, whose interest and charge is the overall financial well-being of your organization, but who you are also trying to guide towards governance rather than operational responsibilities.

Sample Statement of Activities with Columns Collapsed

The goal for the process is to design a system that holds and communicates the financial information you need to manage your organization well and support effective financial strategies. At the same time, when appropriate, we hope to avoid muddying decision-making with too much detail or cumbersome presentation formats. The process of choosing your columns is likely to bounce back and forth between principle and practicality, as you rethink and redesign your accounting and finance systems to match your strategic and operational needs.

For information about setting up or refining your chart of accounts, please read the next segment of this series: Part 2 – Defining Rows. And please join us for a webinar in partnership with CompassPoint on April 23, 2025, to hear more about how to align your accounting system with your mission.

Register for the webinar here!

Post written by Shétu Rose, Co-Founder and CEO, and Curtis Klotz, CPA, Co-Founder and Chief Learning Officer, Diverge Finance Cooperative.